The Power to Underwrite Anyone: Introducing the Nova Credit Platform

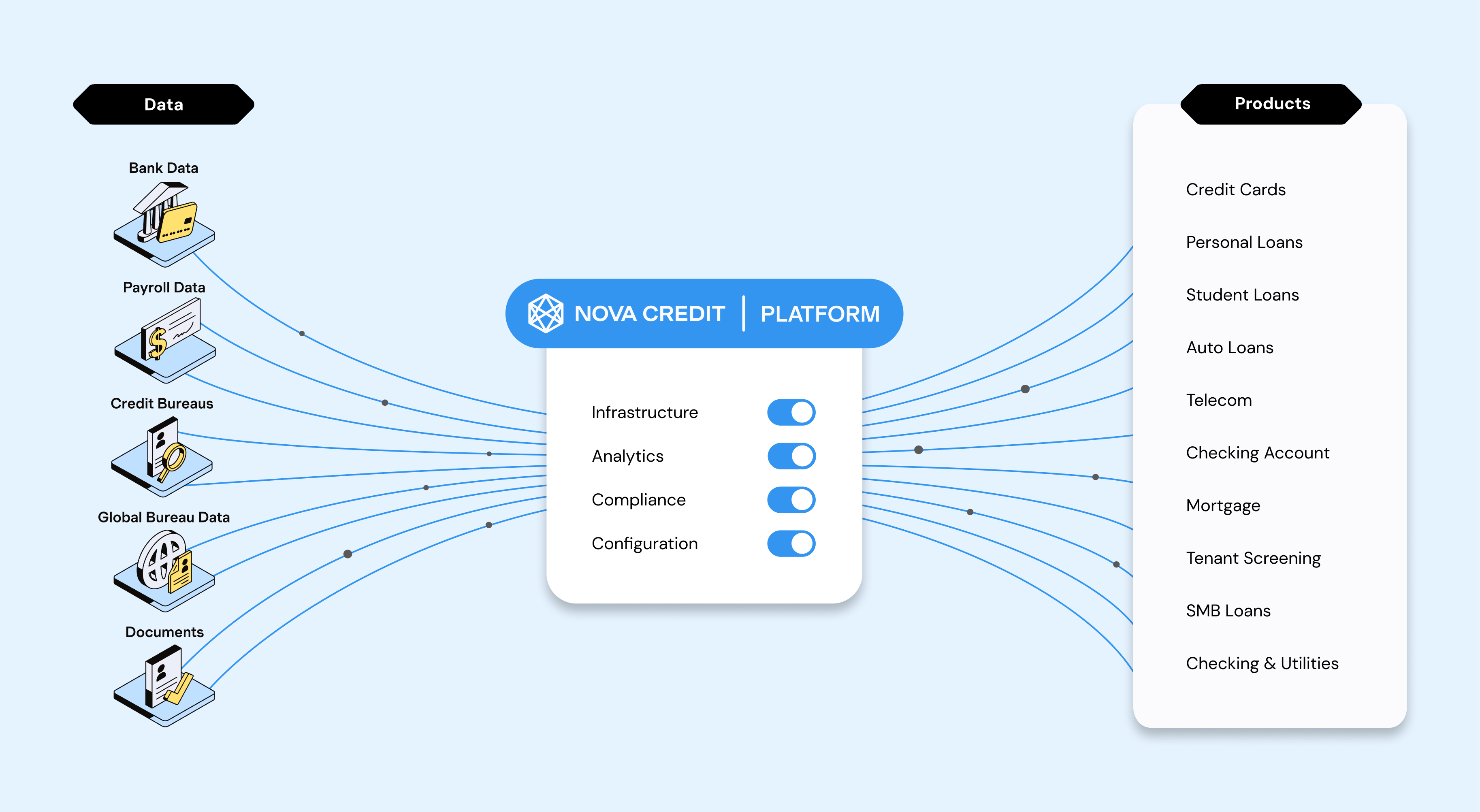

The Nova Credit Platform is a significant development in Nova Credit's ability to give lenders the power to underwrite anyone. Yes, anyone. Read Misha Esipov's comments on the launch to understand how and why we are powering a more fair financial system.

Today, credit bureau data is murkier than ever. Traditionally reliable credit risk signals are increasingly difficult to discern amidst a slew of credit builder products, soft inquiry data, Covid government stimulus programs, BNPL data gaps, and other noise. The credit bureaus are doing the “right thing” for consumers by increasing the number of reporting sources and tradelines on record, but the inadvertent consequence is that the core corpus of the credit bureau is more difficult than ever to understand. With the U.S. set to embrace open banking, it’s a critical moment for the credit industry to modernize.

It’s also a critical and proud moment for us at Nova Credit. This week we announced the launch of the Nova Credit Platform, a significant development in our ability to give lenders the power to underwrite anyone. Yes, anyone.

For years, we have been talking about what credit bureaus have lacked, leaving too many people excluded from the credit system—whether they’re newcomers to the country, thin-file Americans, or a range of other misunderstood segments. Nova has empowered lenders with the vision to better see the credit invisible and extend credit safely. To date, we have helped our partners unlock well over $10B in credit for their customers through our Cash Atlas™, Income Navigator, and Credit Passport® products—a major milestone in our journey to build a more fair and inclusive financial system for the world.

But we’re not done yet. Lending institutions can now use the Nova Credit Platform to grow responsibly by streamlining onboarding, verification, and underwriting processes of alternative data with a unified integration. As a hub, powering our suite of solutions, the platform enables customers to quickly onboard, orchestrate, and analyze consumer credit data from a range of alternative sources, all within a consumer reporting agency (CRA) compliant framework.

The credit industry and open banking will drive a sea change in financial inclusion and responsible growth, however, executing this transformation while ensuring compliance and consumer-permissioning of data transactions will not be easy. The future for successful financial institutions and positive consumer outcomes depends on ingesting a full suite of new credit data capabilities and using them compliantly.

Seven years ago, we founded Nova Credit to bridge the gaps in equitable access to the credit system and this week’s announcement is a big step forward in driving the next era of Nova’s journey. We couldn’t be more energized and committed to our mission.

Open banking and the next era of financial inclusion

We’ve come a long way, but have a ways to go. Today, more than 100M Americans still struggle to gain fair access to credit and consequently, other essential resources such as housing.

With the CFPB's proposed 1033 rule, the U.S. is poised to enable consumers to securely share their financial data with third-party providers to improve access to financial products and services, through “open banking”.

Many leading financial institutions and fintechs have proven the value consumer-permissioned data brings to drive growth while supporting safety and soundness. However, the current data supply chain (and existing credit data workflows) make it difficult for companies to effectively scale data access and seamlessly deploy risk analytics into actionable credit decisioning. Of particular concern, companies have struggled to embed frictionless permissioning workflows to drive conversion and navigate a range of analytical and compliance questions. Overcoming these obstacles is critical to benefit from capabilities like cash flow underwriting, automated income verification, risk monitoring, fraud controls, cross-border credit, and more.

As former Chief Risk Officer of Discover, Brian Hughes, said, “Data is not enough. The best credit solutions and opportunities can only be unlocked by the combination of resilient infrastructure, best-in-class data science, and reliable compliance. This allows lenders to focus their energy on what they already do best.”

Learnings from 7 years of scaling credit data infrastructure

We share Brian’s view and designed the Nova Credit Platform to do exactly that. Some of the world’s largest banks and partners have relied on Nova Credit to unlock the value of alternative credit data with deep analytics expertise and its comprehensive compliance framework. The launch of the Nova Credit Platform is the next step in providing the market with a suite of solutions built on a unified, flexible platform infrastructure designed to help lenders and companies better understand a growing base of underserved consumers.

Over the last 7 years, we’ve built infrastructure and analytics that power industry-leading solutions like Cash Atlas™ for cash flow underwriting, Income Navigator for automated income verification, and Credit Passport® for cross-border credit. These products have helped dozens of major customers such as HSBC, SoFi, Scotiabank, and Yardi leverage alternative data, adopt new capabilities, and reach more valuable customers.

It’s clear many companies lack the infrastructure, analytics, and tech budget to overcome this challenge quickly and at scale. Many of the individual data sources struggle to pass a bank’s ROI threshold, but when combined in concert, the business case quickly compounds.

We repeatedly hear a common set of questions: How can we better understand new segments? How can we customize products more effectively? How can we extract deeper insights from the data we already have? How can we ensure risk and compliance requirements are met across our workflows? How can we ensure maximal coverage, uptime, and data quality? How can we use all these resources together to make faster, more accurate decisions?

As the U.S. dives deeper into open banking and the market for cash flow underwriting matures, the sense of urgency is growing with greater pressure on lenders’ ability to identify and adopt solutions to these questions quickly.

The future is a platform

Platform partnerships will unlock speed and scale for a quickly evolving market of alternative credit data. Through platform partnerships, financial institutions gain access to infrastructure that delivers coverage, flexibility, ease-of-use, and reliability; analytics that combine data science engineering with deep credit expertise to develop risk-predictive attributes and scores advantageous in decisioning; and enterprise-grade compliance encompassing solution-wide frameworks to meet regulatory requirements, including consumer-permissioning, adverse action codes, dispute management, and fraud prevention.

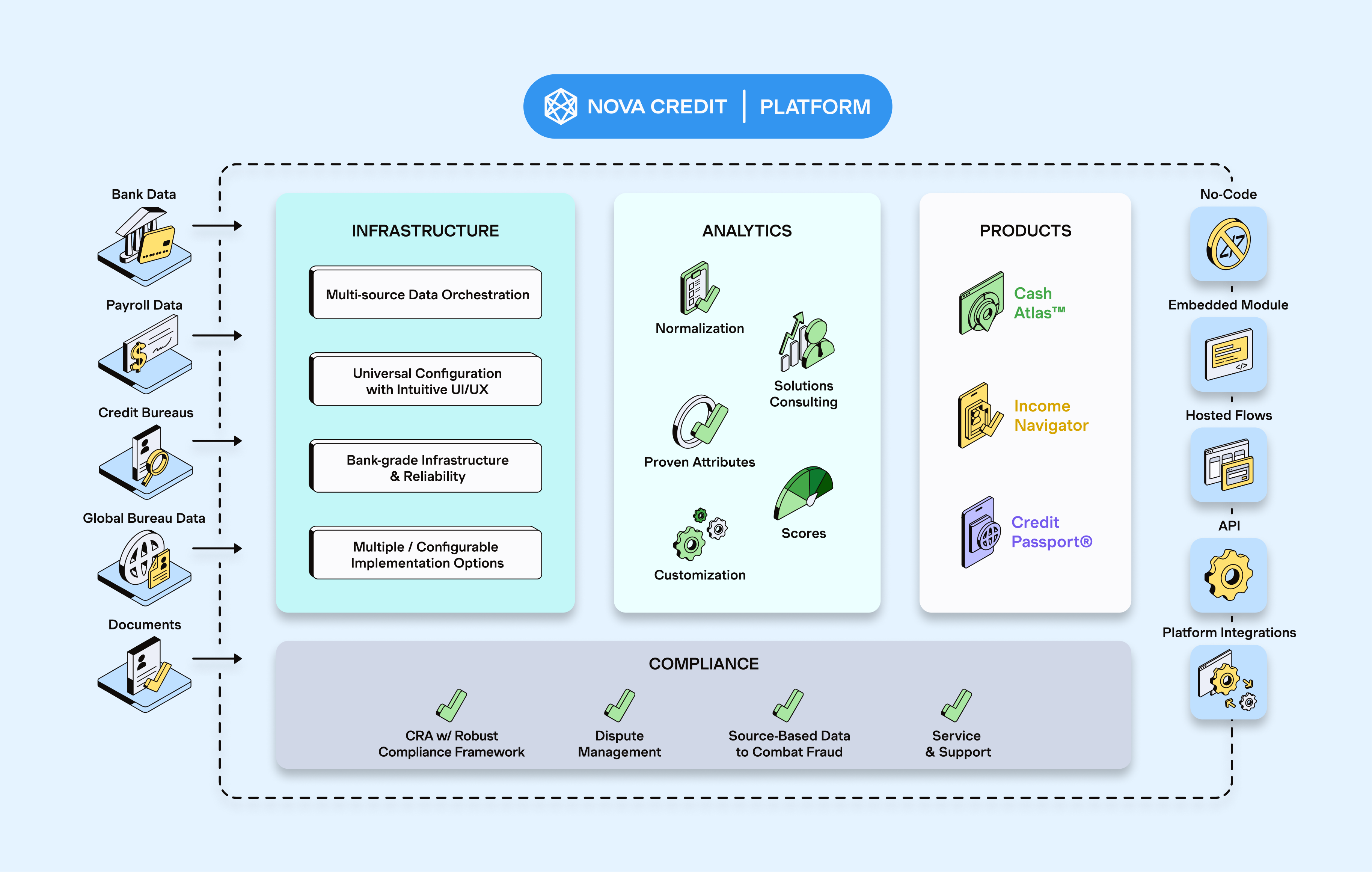

We developed the Nova Credit Platform in four key areas to set the standard in alternative data and credit risk assessment:

(i) Infrastructure: Robust infrastructure with multi-source data orchestration and intelligent routing - all data providers have pros and cons. Some excel in coverage, others in uptime, and others in quality. We’ve found that intelligent routing across multiple types of data partners can maximize coverage, ensure continuous uptime, and optimize latency and conversion. In the same way that every leading bank partners with multiple credit bureaus, we believe every leading bank will partner with multiple alternative data aggregators. Doing and maintaining that work in-house is a tremendous effort and we’ve made it seamless. The Nova Credit Platform offers a universal configuration with intuitive UI/UX to enable customers to pull and deploy from traditional U.S. & International credit bureaus, 95% of US deposit accounts, 80% of the U.S. workforce through payroll systems, a range of documents, and more.

(ii) Analytics: Embedded analytics for cash flow underwriting, income verification, cross-border credit, and more – the Platform standardizes raw data from our multi-source infrastructure, categorizes and classifies data, and delivers over 1,000 decisionable attributes, and more. Credit models are only as good as the underlying data on top of which they are built. Our Analytics offer a wealth of orthogonal data insights to complement and improve upon traditional bureau data. These analytical constructs are based on industry-wide data and see a higher lift as a result.

(iii) Compliance: End-to-end compliance and fit-for-purpose credit expertise – Alternative data has cropped up in many industries, but credit is unlike any other industry in that it has a unique and heightened level of regulatory and data privacy complexity. Nova Credit was forged as a cross-border credit bureau, navigating complex regulatory requirements for some of the most highly regulated financial institutions in the US and around the globe. As we expanded our products and capabilities, we embedded our unique credit bureau DNA into everything we do. Our Platform is built with these considerations in mind enabling lenders to approve, decline, and send adverse action notices, all while Nova Credit manages disputes.

(iv) Configuration: Flexible deployment within your credit process – Companies large and small have deployed our capabilities to carefully navigate user experience, credit risk insight, and tech budget constraints. The Nova Credit Platform can be leveraged to solve a range of use cases with multiple implementation paths, ranging from no-code, to low-code, to full API, and can be used across digital and retail channels. We’ve also invested in partnerships to ensure that our full suite of connectivity can be made available through many of the industry’s leading third-party decisioning systems (Alloy, Taktile, Provenir, and more).

The Platform strengthens and broadens Nova Credit’s existing product offerings in cash flow underwriting (Cash Atlas™), income verification (Income Navigator), and cross-border credit (Credit Passport®), delivering access to enriched consumer-permissioned credit data and analytics at any stage of the credit workflow through a single integration. In conjunction with the products, the Platform ensures enterprise-grade reliability for institutional coverage, maximum uptime, and latency optimization. As population segments evolve and more credit data emerges, this unified platform integration continuously helps paint a more complete picture, assess risk, and identify opportunities within a growing base of applicants and existing customers.

I’m very proud of our teams and want to thank both them and our many partners. The Nova Credit Platform is a culmination of years of hard and persistent work to create a better credit data system once and for all. I know that I speak for the entire Nova team in expressing our excitement about the impact we know the Nova Credit Platform will have on building a more fair and inclusive financial system.

The Nova Credit Platform is live and used by leading companies such as HSBC, Scotiabank, SoFi, and Yardi. To learn how to scale onboarding, underwriting, and verification processes, connect with our team at novacredit.com/connect-nova-credit or learn more at www.novacredit.com/platform.