Nova Credit Platform

Data is Not Enough

Tomorrow's credit decisions demand flexible infrastructure, embedded analytics, and end-to-end compliance that can address a variety of workflows and models at scale.

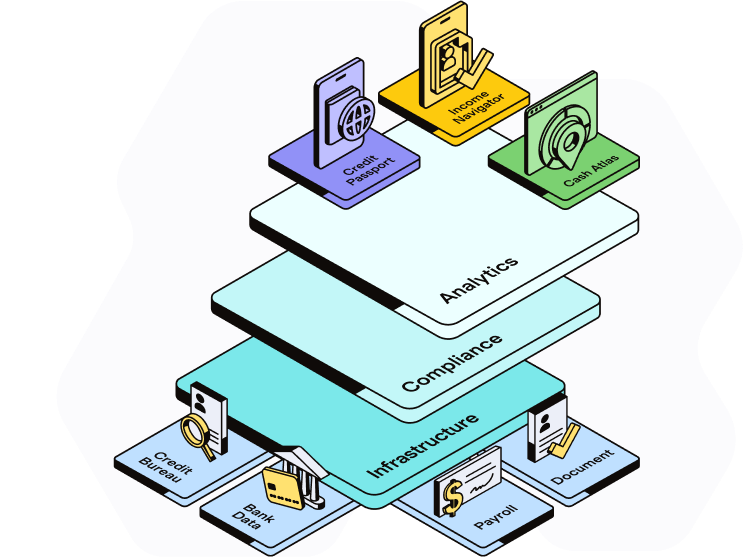

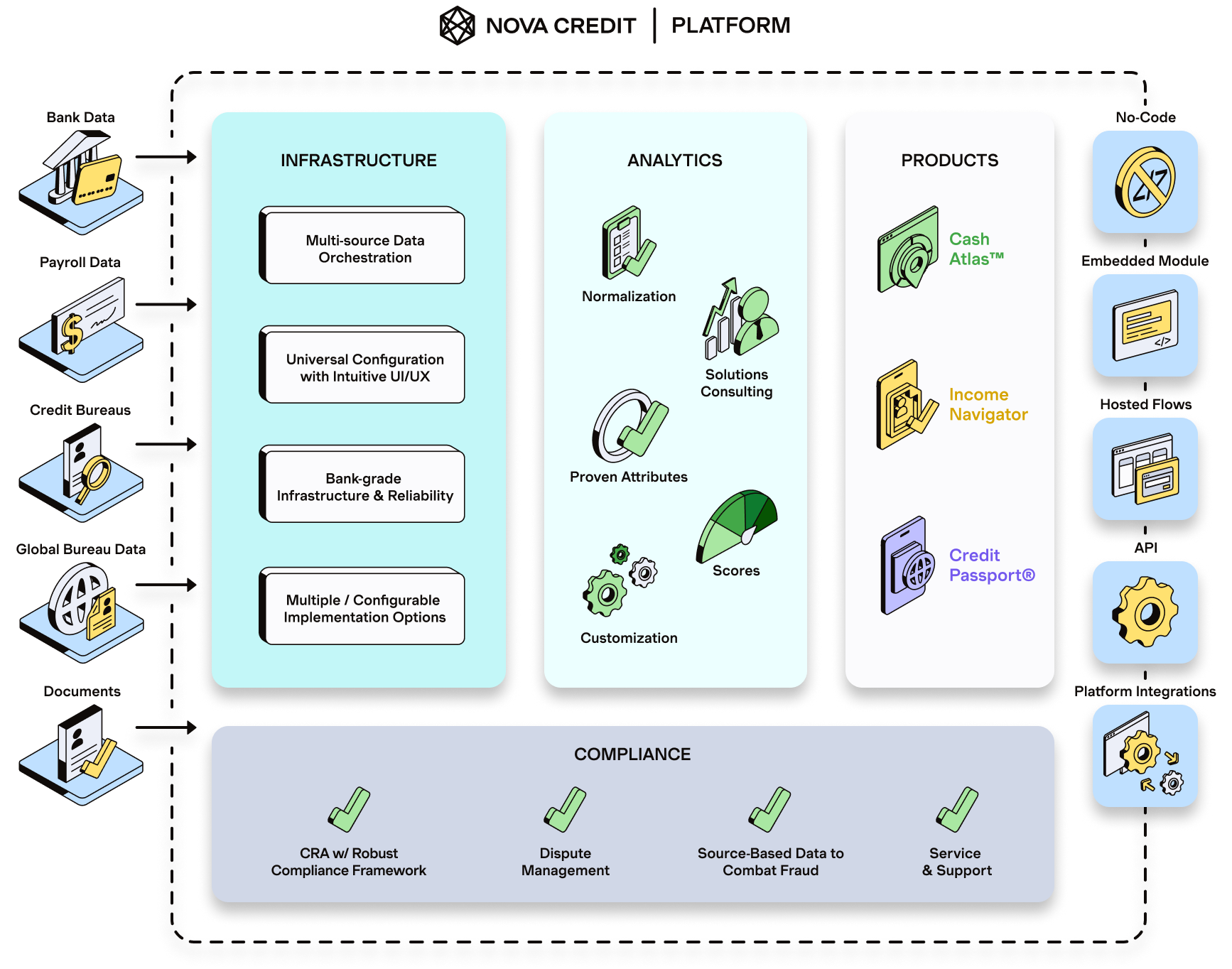

A single platform to infuse alternative credit data into your workflows

We’ve combined the best attributes of a credit bureau with flexible infrastructure and analytics, enabling credit decision-makers to harness the power of alternative credit and open banking data.

Platform Benefits

Optimize coverage and deployment to (actually) improve performance

Increase Coverage

Leverage transaction data from sources including first-party data, credit bureaus and multiple aggregators.

Improve Uptime to 99.9%

More coverage and enterprise-grade infrastructure means your workflows are always ready.

Optimize Latency

Enterprise-grade infrastructure and data connectivity to optimize latency.

Compliant Analytics

The Platform ensures embedded analytics meet compliance threshold.

Supporting Enterprise Scale

Consumer Reporting Agency (CRA) Compliance

Nova Credit accesses consumer-permissioned data through integrations from international credit bureaus and through data aggregators for checking and savings account data in the United States. Businesses can approve, decline, and send adverse action notices, while Nova Credit manages disputes. Nova Credit operates as a consumer reporting agency under the FCRA.

Expert Analytics & Guidance

Nova Credit is led by a team of experts in credit risk and lending. Our dedicated services team delivers trusted integration services, strategic advice, and ongoing support.

Speed to Go Live

Our consumer-permissioned risk data can be implemented 9-12 months faster than custom in-house alternatives that require high resourcing costs to build international bureau partnerships, data categorization, or attributes based on bank transaction data.

Purpose-Built for Credit Risk

Our solutions are designed to predict creditworthiness by transforming new data sources into proven risk insights.

Trusted by:

Platform Metrics

26

Data sources across traditional credit bureaus, bank data aggregators, payroll systems, and others.

80%

Conversion lift with customers seeing up to an 80% increase in conversions vs. prior solutions.

< 8

Weeks to go live with enterprise customers receiving production data in less than two months.

Introducing the Nova Credit Platform

One integration to a world of credit data

Learn more about the platform and our vision for the future of consumer credit data onboarding and underwriting.

Explore the Future of Consumer Credit Today

Submit your information and a member of our team will be in touch about how we can grow your business together.