How to Apply for a Credit Card with an Independent Taxpayer Identification Number (ITIN)

This article provides an overview of the Independent Taxpayer Identification Number (ITIN), including what an ITIN is, how it is different from an SSN, and how you can use it to apply for a credit card in the U.S.

Nova Credit is a cross-border credit bureau that allows newcomers to apply for U.S. credit cards, phone plans, and loans using their foreign credit history.

Many of the card offers that appear on this site are from companies from which Nova Credit receives compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). Nova Credit does not include all card companies or all card offers available in the marketplace.

While many credit card companies require a Social Security Number (SSN) to apply for credit cards, there may be other options if you are an international student or another foreign resident in the U.S. who is not eligible for an SSN.

This article will provide an overview of an alternative option called the Independent Taxpayer Identification Number (ITIN), including what an ITIN is, how it is different from an SSN, and how you may be able to use it to apply for a credit card in the U.S.

What is an ITIN?

An ITIN is a unique tax-processing number issued by the Internal Revenue Service (IRS) for those who pay taxes but are not eligible for an SSN. This includes residents with foreign status and undocumented immigrants.

Should you have an ITIN or an SSN?

There are a variety of differences between an SSN and an ITIN. An SSN is commonly used in use cases beyond taxes and can only be obtained if you have authorization to work in the U.S. An ITIN is primarily used for tax reporting and does not need authorization to work. At can sometimes enable you to open a bank account or apply for a credit card in place of an SSN.

If you are authorized to work in the United States, either as a U.S. citizen or foreign national on a valid work visa, you can apply for an SSN. Students on F-1 and M-1 visas are eligible to apply for an SSN as soon as they have a job, including on-campus jobs and off-campus work through CPT or OPT.

If you are an international student who is not working yet, a dependent of someone on a work visa, or are otherwise not authorized to work, you can only apply for an ITIN.

In the case of international students who are not working, they will still need an ITIN to:

Pay taxes on scholarships, grants, or fellowships received from a U.S. source

Pay taxes on passive income, such as dividend payments or capital gains on U.S. stocks

Claim tax deductions or credits, if the student comes from a country that has a tax treaty with the U.S.

How to apply for an ITIN

The Internal Revenue Service (IRS) will only issue an ITIN if it is required for a tax return.

To apply for an ITIN, you must file Form W-7 with the IRS. This will ask for personal information such as your name and reason for applying, as well as your tax documents and proof of identification.

You can apply for an ITIN at any time of the year where you have a tax filing requirement. Once your application is submitted, it will take the IRS approximately 7-11 weeks to issue your ITIN.

How to apply for a credit card with an ITIN

Fortunately, you can apply for a credit card with an ITIN from many of the major credit card issuers.

For example, you can apply for any American Express personal credit cards online with an ITIN, if you have credit history in one of the following countries: Australia, Brazil, Canada, Dominican Republic, India, Kenya, Mexico, Nigeria, Philippines, South Korea, Switzerland, or the U.K.

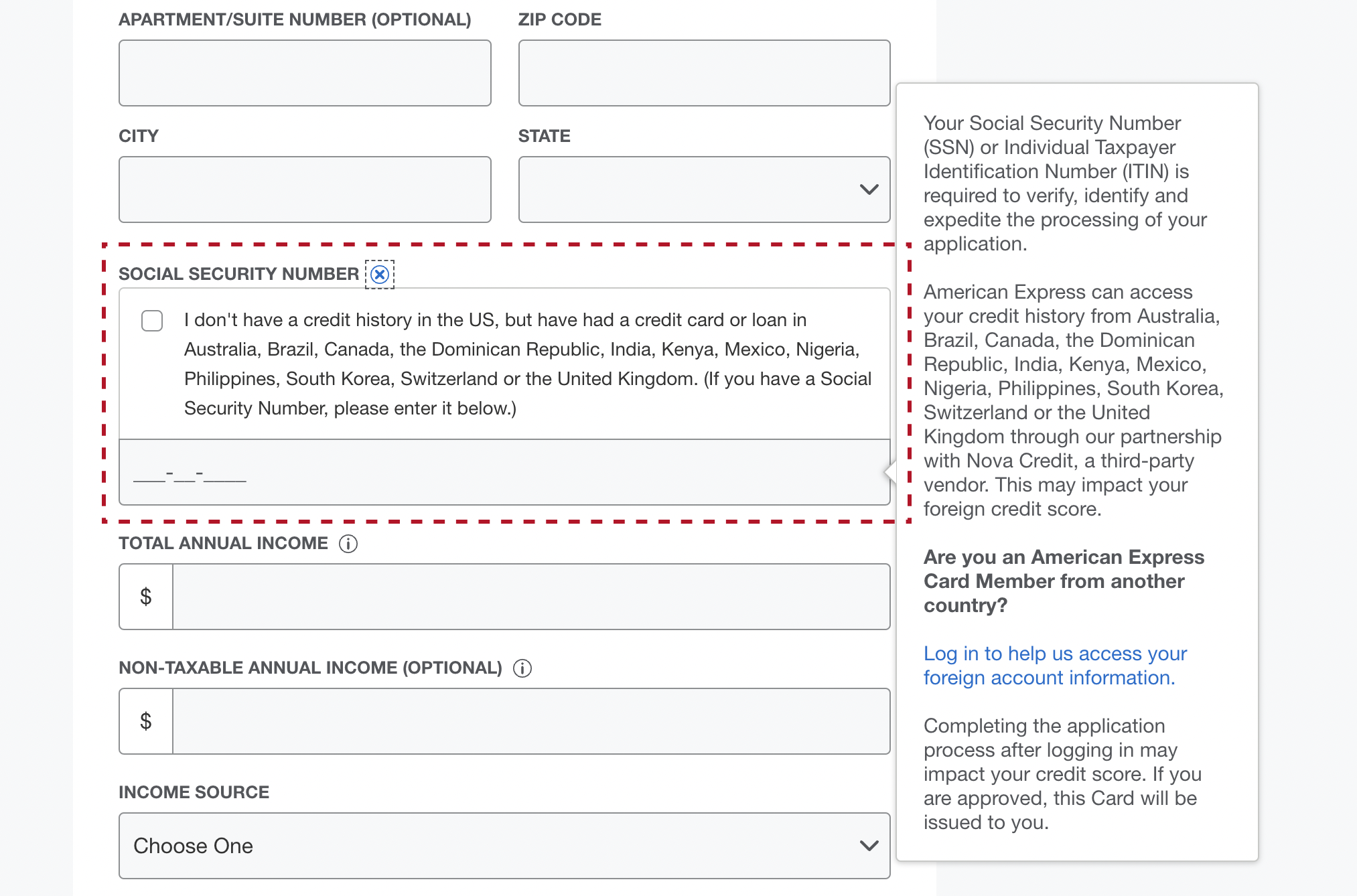

On the AmEx credit card application, input your ITIN in the field that asks for an SSN.

If you have recently moved from one of the supported countries, make sure to check the box above where you’ve entered your ITIN (in the Social Security Number field) that says “I do not have credit history in the U.S., but have had a credit card or loan in…” This will prompt American Express to ask you to use your foreign credit history later in the application.

To choose an American Express card, consider how you want to use the card, your normal purchasing habits, and your lifestyle.

Here are a couple of our featured picks:

American Express Blue Cash Everyday®

If you’d prefer to avoid an annual fee, the Blue Cash Everyday® Card from American Express might be a great choice for you.

American Express Gold Card®

If you want to access a great welcome offer and earn 4X Membership Rewards® (MR) points at restaurants worldwide (on up to $50,000 per calendar year, then 1X points for the rest of the year), and earn 4X Membership Rewards® (MR) points at U.S. supermarkets (on up to $25,000 per calendar year, then 1X for the rest of the year), the Gold Card® may be a great choice for you:

Beyond American Express, other banks like Bank of America, Chase, and Capital One are known to allow applicants to apply for credit cards with an ITIN—especially for secured cards or student cards. If there is not a clear option to input the ITIN in their online application in place of an SSN, you can try to call the bank or go into a branch.

Building a U.S. credit history with an ITIN

If you are approved for a credit card, responsibly managing that card will help you to build a credit history in the U.S. By making consistent on-time payments and keeping your credit utilization low, you can establish a U.S. credit score in as little as a few months.

Note: you do not need an SSN to start building your U.S. credit history. While specified personal information like an SSN or ITIN make it easier for credit bureaus to report information accurately, these bureaus will track and match your name, birth date, and address to your credit history.

With your first credit card in hand, you can also apply for a variety of other products such as phone plans, auto loans, and more using your foreign credit history through Nova Credit—many of which do not require an SSN.

Currently, Nova Credit serves individuals coming from Australia, Brazil, Canada, Dominican Republic, India, Kenya, Mexico, Nigeria, Philippines, South Korea, Spain, Switzerland, and the U.K.

Over 100,000 recent newcomers trust Nova Credit

Subscribe to our newsletter for the latest tips and information on setting up life in the U.S.

More resources: